As an entrepreneur you need to know not only what and how to sell, but also how to find the money you need to start or to grow your business. Obviously you can start your business using only your own money, but if you manage to attract finances, you will be able to grow your business much faster.

There are various options for raising funds by startups, each of which is associated with certain consequences. Going through this part of the handbook will help you understand what funding sources are available at different stages in the development of a startup, but also how you can attract finance using these channels.

so, let's identify the most suitable source of funding for your startup.

How to find financing for startup

If the financial projection of the future business shows you that it will be profitable, but you will have a profit only a few months after the launch, you need to think about how you make the business work and reach the break-even point.

After you have shown in the financial model what are the startup costs, but also the periods of activity that still do not allow you to fully cover your expenses, you need to find money to cover these costs and losses.

Being at the stage where you only have the business idea and some projects on how it works, it will be quite difficult to attract financing from creditors or investors, you have to think about how you could self-finance the startup. Self-funding, also known as bootstrapping, is an effective way of startup financing, specially when you are just starting your business.

How to finance startup by Bootstrapping

What is Bootstrapping?

Bootstrapping is building a company from the ground up with nothing but personal savings, and with luck, the cash coming in from the first sales.

Bootstrapping, is an effective way of startup financing, specially when you are just starting your business. First-time entrepreneurs often have trouble getting funding without first showing some traction and a plan for potential success. You can invest from your own savings or can get your family and friends to contribute. This will be easy to raise due to less formalities/compliances, plus less costs of raising. In most situations, family and friends are flexible with the interest rate.

Bootstrapping is also about stretching resources both financial and otherwise as far as they can.

Being only at the launch stage of the business, look for ways to reduce expenses. Check the list of below, hope you will find some useful ideas to cut startup costs.

Review all expenses, even the little ones

If you are not keeping a record of all your expenses, you should start doing it. This records can help you categorise expenses and help you take measures to reduce them.

Use 80/20 principle

Paretos 80/20 principle states that 80% of the outcome is caused by 20% efforts. You can apply this powerful principle to limit expenses on those 80% activities that are not generating enough income for you.

Use low-cost advertising

Traditional advertising methods can get very expensive. Explore new tools like Google AdWords & Facebook Ads to advertise your product to the targeted audience. Bu using this tools you can target users from a specific city, age-group and demographics and get good returns on your marketing investment.

Cut Office Expenses by using cloud

You can save a lot of time and resources by adopting cloud computing. Employees can work remotely and use online collaboration tools to get the work done. For example, you can use Dropbox, Google Drive to share files, ProfitBook for managing finances online, Skype, Zoom etc. to have virtual meetings.

Have virtual meetings

You can ask your clients to have online meetings. Using the latest technology, you can save a lot on travelling expenses.

Use open source software

You can save a substantial amount of money if you start using open source software. There are a lot of open source softwares like CRM, Document management, etc. are available which are easy to use and dont cost money.

Cut equipment costs

being at the starting line do not invest money in equipment, use your personal computer, some equipment at home, or use the spaces for beginner entrepreneurs, who usually have some equipment that you can use.

Track inventory closely

If you run an inventory-based business, carrying less inventory means having less money tied up and more money in the bank. Begin monitoring inventory more closely to make sure you arent spending more than is really needed.

Sell online

This can save huge costs in marketing and inventory maintenance. In fact, this is something which you can let you operate from a small room.

Hire smart, inexperienced people.

Experience is important but it isnt everything, and it comes at a cost. For critical work scenarios, you have no option but to go for experienced people but in most cases, the strategy of training freshers works.

You will not only gain a monetary advantage by providing an entry-level salary but you will also benefit by having employees who are enthusiastic, up-to-date on the latest technology, nimble and eager to learn.

Commission your sales force

If you prefer to have an in-house sales team, try to structure their salaries in such a way that larger percentage is allocated to commision and a fixed component is on a lower side.

Outsource Non-Critical Tasks

There are a lot of tasks that can be outsourced these days. You can hire freelancers to design company logo, do social media promotion, maintain accounts, generate sales leads and much more.

Success story:

# Plenty of Fish

Plenty of Fish, one of the largest and most popular dating sites in the world, founded by Markus Frind, became a full-time business in 2004. Until 2008, Frind conducted his startup from his apartment, and then eventually acquired a new Vancouver, Canada headquarters where he began hiring other employees

As of June e2020, Plenty of Fish had over 150 million registered users worldwide and is adding an average of 65,000 new users every day. The free app is available in 11 languages and more than 20 countries on iOS and Android devices. The company makes money via advertising as well as offering premium services as part of their upgraded membership.

Bootstrapping should be considered as a first funding option because of its advantages. When you have your own money, you are tied to business. On a later stage, investors consider this as a good point.

How to find finance when bootstrap is not a solution

Bootstrap is a good financing solution but it is not universal. This is suitable only if the initial requirement is small. Some businesses need money right from the day-1 and for such businesses, bootstrapping may not be a good option. At the same time, businesses that can handle small expenses at the start stage will need investment to grow.

To attract financial resources you can use several sources accessible to start-ups. The first financing option you can apply for is lending.

But, many lenders don't work with startups simply because new businesses can be a risky investment. No business is a sure thing, but new businesses can be especially unstable. For this reason, in most cases, lenders ask for businesses to have a certain amount of profit or be a certain age. Those criteria exclude most startups from qualifying for business loans, making it incredibly difficult for them to get funded that way.

While it's not easy to get approved for certain types of business loans as a startup, plenty of other options are available.

microfinance - is designed specifically to help new businesses get off the ground. Microfinance it is increasingly becoming popular for those whose requirements are limited and credit ratings not favoured by bank;

microfinance - is designed specifically to help new businesses get off the ground. Microfinance it is increasingly becoming popular for those whose requirements are limited and credit ratings not favoured by bank;

supplier credit - if you're already working with a supplier or vendor to provide you with products or services, consider asking if you can set up a supplier credit arrangement. This will allow you to defer payment to a later date, say 30 or 45 days in the future, possibly with no interest. A supplier credit arrangement can make it easier to manage your cash flow, as it gives you time to convert those costs into sales to your customers.

supplier credit - if you're already working with a supplier or vendor to provide you with products or services, consider asking if you can set up a supplier credit arrangement. This will allow you to defer payment to a later date, say 30 or 45 days in the future, possibly with no interest. A supplier credit arrangement can make it easier to manage your cash flow, as it gives you time to convert those costs into sales to your customers.

personal loans - instead of working with a business lender, you might be better off applying for a personal loan.

personal loans - instead of working with a business lender, you might be better off applying for a personal loan.

What you need to consider if you finance your business through lending

#1 The loan involves repayment - to ensure that you will be able to repay the loan, add monthly payments in the financial model (Cash Flow Forecasting table) and see how the cash flow will be affected. To find out how much you have to repay each month, use the calculator on the bank's website - select the type of loan, the amount and the period and it will give you information about the monthly payments.

#2 Creditors, especially the bank and microfinance provider, offer loans against an interest, at the same time different fees may be charged. Before applying for credit, carefully analyze the credit conditions.

#3 Creditors usually require certain company or personal assets as collateral. In case you are not able to repay the loan you could lose the goods offered as collateral.

To avoid problems related to loan repayment, you can look for special sources for financing startups.

Startup financing through crowdfunding

One of the most effective fast and modern way to get fund for startup is crowdfunding. Crowdfunding brings a lot more benefits than just raising money. Through effective planning and strategy of your organization can get the most benefit from the campaign.

Lets learn the basics about Crowdfunding.

What is crowdfunding?

Crowdfunding is an Internet-enabled way for businesses or other organizations to raise money in the form of either donations or investments from multiple individuals

The term defines the practice of initiating an open call to an undefined network of people, for the provision of needed services, ideas or content. The basic premise is that the small input of many has greater value and impact than the large contribution of a few.

This new form of capital formation emerged in an organized way in the wake of the 2008 financial crisis largely because of the difficulties faced by artisans, entrepreneurs and early-stage enterprises in raising funds. With traditional banks less willing to lend, entrepreneurs started to look elsewhere for capital.

Crowdfunding is fundamentally about creating and exchanging value. We encourage you to think critically about what value you are creating, why people are interested in the work you are doing, and how you can build opportunities for the crowd to participate in your efforts.

There are some advantages of crowdfunding listed below:

Raise money Usually the main goal, but not the only one.

Marketing and cause awareness The very act of crowdfunding gets the word out about the issues you are engaged with.

Market validation It can provide validation for new initiatives allowing the crowd to vote with their dollars in support of your efforts. You could also leverage the crowds support as key evidence when obtaining other types of funds (i.e. grants).

Testing marketing channels and target audience A great way to see if a specific project resonates

with a specific target audience.

Connect with new audiences The buzz that you create can bring new relationships that you can leverage going forward.

Understand your audience Get to know more about the level of support from certain target audiences, issues that resonate, what people say about you via social media, etc.

How does it work

The first time someone hears about your project might not be the best time to include a request for money. Around a month before your project starts, you should spread the word to friends, family, colleagues, and any relevant groups or organisations who might support you later on. This is called a soft launch and can be a very effective way of gaining support so that when you do launch, you can start with a bang!

Crowdfunding typically involves some key players and stakeholders:

Crowdfunder

Crowdfunder

The crowdfunder can be a backer, donor, or investor. Individuals make the most of the market, but private and public institutions can invest and/or donate as well.

Beneficiary-investee

Beneficiary-investee

person or organization seeking funds for a company, product, project, or initiative. There is a vast range of actors from small companies, NGOs, individuals, start-ups, etc.

Crowdfunding platforms

Crowdfunding platforms

Online platforms connecting the crowdfunders with the beneficiary or investee. They charge commissions for participation and/or on interest/dividends.

Platforms

Platforms

can provide a wide range of services, including financial due diligence, contracting, etc.

Third party verifier and other service providers

Third party verifier and other service providers

Platforms and beneficiaries/investees can rely on a number of service providers. Platforms may need to buy servicese.g. financial due diligenceor outsource the assessment of social and environmental outcomes.

Sponsors

Sponsors

Beneficiaries may obtain support in designing and running crowdfunding campaigns. These services can be offered pro-bono or on a commercial basis.

You can also find new members of your tribe using a blog, or social media sites such as Facebook and Twitter. Theres obvious benefit to linking all your profiles and pages together, and to your project page. The rise of social media sites has made it much easier for fundraisers to find people willing to contribute to their campaigns. The growth of crowdfunding, and the associated success of many crowdfunding campaigns, is now heavily attributed to social media and networks.

Credible crowdfunding systems require enabling legislation, and their success depends on supporting ecosystems and other enabling factors. These include:

forward-looking standards that balance the need to protect investors with capital accumulation;

forward-looking standards that balance the need to protect investors with capital accumulation;

effective technology solutions that include reliable broadband Internet or mobile data networks;

effective technology solutions that include reliable broadband Internet or mobile data networks;

and supporting institutions that offer training, mentoring and other services to beneficiaries and investors.

and supporting institutions that offer training, mentoring and other services to beneficiaries and investors.

What crowdfunding models you can meet

When launching a crowdfunding project, it is important to understand what the project objectives are and who the target audience is. Different models of crowdfunding are best suited for different types of projects.

No 1. DONATIONS-BASED CROWDFUNDING

The crowdfunder donates funds without expecting any return. Donations are typically used to support disaster relief, famine, education programmes, etc.

Examples:

JustGiving - https://www.justgiving.com

GoFundMe - https://www.gofundme.com

No 2. REWARDS-BASED CROWDFUNDING

The crowdfunder transfers funds with the expectation of a reward, which may be in the form of a token gift or an early/exclusive release of a product or service offered by the startup company.

Examples:

Kickstarter - https://www.kickstarter.com

Indiegogo - https://www.indiegogo.com

No 3. LENDING-BASED OR PEER-TO-PEER (P2P)

the fastest growing type of crowdfunding has a 73 percent market share. The crowdfunder lends money to individuals or companies in return for interest. While there are platforms exclusively targeting socially-oriented lending, the majority operate as commercial platforms in direct competition with other financial intermediaries

Example:

KIVA - http://www.Kiva.org

is providing small loans (from US$100-US$100,000) to farmers, NGOs and SMEs.

No 4. EQUITY-BASED CROWDFUNDING

The crowdfunder purchases equity in a company. Equity is a new, yet rapidly growing, model in crowdfunding. Equity-based crowdfunding remains highly dependent upon supportive regulatory frameworks, which often restrict equity investment to professional investors.

Example:

EquityNet https://www.equitynet.com

A successful crowdfunding campaign may draw on a platform with a wide audience, such as Kickstarter, Indiegogo, Kiva, or GoFundMe. New platforms may also be established under certain circumstances. There are numerous resources on crowdfunding, including blogs, books, networks, and training, including guides on running campaigns from Indiegogo, Fundable, Kickstarter, Crowdfunding Guides, and Shopify. For many potential donors, this is where they will hear about you first, so getting all the information you need on the crowdfunding page without overwhelming them is key.

How to prepare a crowdfunding campaign

Preparing for a crowdfunding campaign should take time it should be well thoughtout, and inspiring. You need to think strategically, and make sure that you are telling a compelling story about your project. People will want to donate to your crowdfunding campaign when they feel inspired. Its worth spending time developing powerful assets to accompany your campaign. There are several key factors for the success of a crowdfunding campaign to consider:

Quality Idea and pitch

A crowdfunding campaign is only as good as the idea seeking funding, which must create or be seen to be creating value in some way. All successful crowdfunding ideas hold some sort of merit. Your pitch should be clear, compelling, and memorable. If you are unable to communicate the idea to others in a manner that is easy to understand in less than 30 seconds, you may need to rethink your presentation. Strength of your network

Campaigns with a larger network are correlated with greater success. Remember to think holistically about the size of your network via your organization, campaign team members, and partners. Also know that even the most popular crowdfunding platforms will generally bring you less than 10% of your total number of backers, so the size and reach of your own network is key!

Marketing campaign

Without undertaking a concerted series of steps to share, disseminate, and communicate, the crowd will not learn about your campaign. It is important to think carefully about how you will market your campaign.

Enticing Rewards

Most successful crowdfunding efforts address the whats in it for me? question for those that are contributing funds to a campaign. Rewards may be tangible or intangible, and are an opportunity to create value for your donors.

Anyone can start a fundraiser through crowdfunding, but its important to be mindful of the steps you take. Doing it correctly the first time around is how successful funding is achieved. To organize a successful crowdfunding campaign for your business idea, you need to remember that creating an attractive page, an interesting video of your product, as well as a constant presence on social networks and rewards are important components along the way. Further each of these aspects well be described that can ensure you hit your campaign targets.

The success of a crowdfunding campaign depends largely on two major factors: how well the campaign is presented and how many people it reaches. If you want to kill both these two birds with one stone, then youre going to need a solid social media strategy.

Email & Social Media Plan

One of the unique things about crowdfunding is its ability to centralize your fundraising efforts and put you closer than ever to your backers and investors. But for all the engagement and social momentum that can come from that, you have to have a plan for keeping everyone informed. That means knowing:

Whom Youll Contact

Whom Youll Contact

Existing customers, committed backers and investors, or potential supporters.

When Youll Do It

When Youll Do It

Before your campaign as a soft-launch, during your campaign as a funding update, or after closing as a big thank you to your supporters.

How Youll Do it

How Youll Do it

Email, Facebook, Twitter, Instagram, Linkedin, Google +, Pinterest, Soundcloud, Reddit, Tumblr, notice boards, newsletters, flyers, forums. You cant put your campaign in too many places.

Planning ahead of time ensures that the time period during which your campaign is live runs smoothly, and allows you to use your campaigning time as efficiently as possible. Most importantly it allows you increase your chances of achieving success.

It is crucial for the success of a campaign to plan your communication in advance. You can use different tools to plan your communication, such as Spreadsheets, Wordpress plugins etc.:

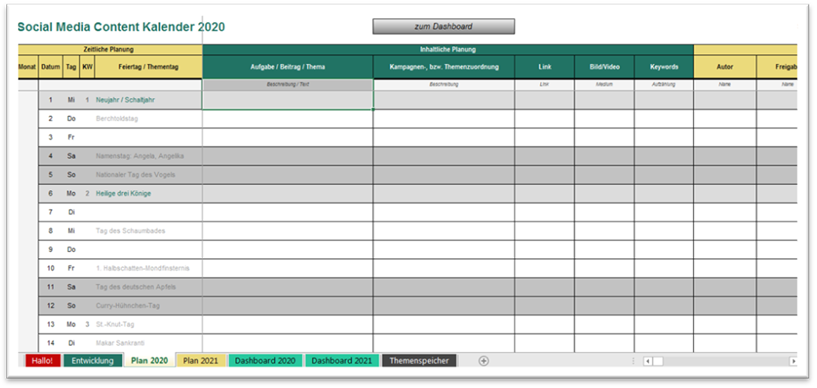

1. Example of social media calendar

Get organized by building spreadsheets that you can use to keep track of key relationships, media contacts, etc. Also include a calendar and/or gantt chart so that you stay on track with all of the outreach efforts that will need to be done. This spreadsheet will be your central repository of campaign execution information, and should be continually updated.

One month at a time is fine for managing your appointments, but it isnt right for blog posts. Blogs care much more about days of the week than months. You want to see partial months more often.

People will follow you if you tweet lots of interesting content. The majority of your tweets should be about relevant topics, and not just about your project. You have to get them interested!

If youre launching a crowdfunding campaign, youll need to carefully consider your campaigns rewardsthe incentives you offer your backers for pledging a certain dollar amount.

Rewards

Think carefully about your rewards. Your goal is to make your rewards relevant to your campaign and entice your target audience to support your campaign.

Types of rewards

Things

Things

An object that backer receives, or can pick, and can look forward to getting it. An item that can increase your brand awareness. Examples: discounted product, DVD, photograph, prototype, t-shirt, bag, digital downloads, etc.

Recognition

Recognition

Let people be recognized in public places. Examples: social media shoutout, email thank you, name in the credits, logo somewhere, etc.

Services

Services

Leverages your teams or others expertise. Examples: Workshop, training, dance lesson, bike tune-up, one-on-one tutorial, etc.

Experiences

Experiences

Something unique that someone normally wouldnt experience. Examples: dinner/lunch with the CEO, apprentice for day, be a builder for a day, meet a VIP, etc.

Access

Access

Give access to allow the backer to participate in the journey. Examples: tickets to event (e.g. launch party), Backstage pass, VIP access to conference, access to information, etc.

The decision of how many reward levels to offer is generally based on the specifics of your particular campaign, what value you can give back, and what reward strategies are being used:

1. a small price point that offers some sort of simple recognition,

2. a mid-sized price point that offers a pre-order,

3. and a large price point that offers special recognition for generous backers. The key takeaway here is to consider offering more rewards for higher target amounts.

This is a great chance to build backer confidence by showing that youve spent the time to chart your businesss course forward. Some common categories we see in rewards campaigns are product development, sales and marketing, recruitment of key personnel, legal and accounting, and operating expenses.

You can use these broad categories as a starting point, but be sure to expand upon them where you can. For example, explain which product features this funding will help you develop, or which key team members youll be able to hire, and what theyll do for your business.

Examples & Success stories

Crowdfunding campaigns are effective enough to stand on their own or work alongside other fundraising efforts. There are hundreds of crowdfunding examples and well look at some of them, that have met their goals and brought about hope and change. Not only have these campaigns succeeded, but they have also expressed their gratitude in effective ways that encouraged even more donors to give:

# SBrick - Smart way to control all your LEGO Creations

Platform: kickstarter, US

Country of the project: UK

Link to project: https://www.kickstarter.com

Amount raised: £88,152

Supporters: 1,284

Reward-based

SBrick is a Smart RC Receiver that connects to a mobile or tablet device, allowing to Control all LEGOs Led, Motor and Power functions from a great distance, which has been developed in Budapest since 2014, founded by some true LEGO fans.

Its first Kickstarter campaign reached almost 1300 backers. than, mostly through word-of-mouth, through social media channels like Youtube, Facebook and Instagram, people all over the world got to know SBrick and SBrick Plus. Now, more than 40,000 people have chosen SBrick to play and learn with.

# GOAT MUG: original goat story crafted into a coffee mug

# GOAT MUG: original goat story crafted into a coffee mug

Platform: https://www.kickstarter.com

Country of the project: Slovenia

Funded: 458.071 $

Target: 25.000 $

Supporters: 10.617

Reward based/Presale

GOAT Mug was launched on Kickstarter as GOAT STORYs first product in 2014. It reached close to half a million dollars in a couple of days. Its a mug-slash-fashion-accessory with an interesting inspiration: the Ethiopian goats that allegedly discovered coffee berries centuries ago. Its shaped like a goat horn, which seems like itd be completely useless when you want to set the cup down, except that its included sleeve doubles as a stand on any flat surface.

In 2016 GOAT STORY created nearly 1.6 million EUR in sales revenue. Two years later, this company upgraded its coffee portfolio with Gina, a smart coffee machine. Gina was a success on Kickstarter as well; they collected more than half a million USD in 2017 and convinced 2.400 supporters.

Specialized quality coffee is an increasingly strong trend in the world, and that is why the brand Goat Story and the coffee segment got more than 300-percent growth in the years 2017 and 2018.

Common mistakes & best practices

While its true that many startups have been able to raise funds through crowdfunding, it should be noted that not every crowdfunding project turns into a success. Thats why its so important that before you launch your campaign, you do your research and have a clear understanding of all the issues that can crop up with a campaign as well as evaluate standard errors and follow the progress already made:

Ordinary errors and lessons associated with crowdfunding:

![]() Starting without a goal or a plan. One of the biggest (and easily avoidable) mistakes nonprofits make in crowdfunding is failing to make a plan and set a clear fundraising goal.

Starting without a goal or a plan. One of the biggest (and easily avoidable) mistakes nonprofits make in crowdfunding is failing to make a plan and set a clear fundraising goal.

![]() Forgetting to rally your supporters (also called, "lack of communication"). Like almost every other type of fundraising, crowdfunding requires communication and engagement with current and potential donors.

Forgetting to rally your supporters (also called, "lack of communication"). Like almost every other type of fundraising, crowdfunding requires communication and engagement with current and potential donors.

![]() Setting your funding goal to high. Keep the limit low, but have good stretch goals to make it attractive to overfund.

Setting your funding goal to high. Keep the limit low, but have good stretch goals to make it attractive to overfund.

![]() Not buffering for the unexpected. So when promising delivering dates for your perks, always add a little bit of a buffer.

Not buffering for the unexpected. So when promising delivering dates for your perks, always add a little bit of a buffer.

![]() Failing to set suggested giving levels. Donors tend to give more money when there are suggested giving levels. It's psychological.

Failing to set suggested giving levels. Donors tend to give more money when there are suggested giving levels. It's psychological.

Also, you need to consider the best methods and practices that you should take for your successful crowdfunding campaign.

Best practices proved:

![]() Setting non-financial goals. Expanding your focus beyond the money will help you get the most out of your crowdfunding efforts.

Setting non-financial goals. Expanding your focus beyond the money will help you get the most out of your crowdfunding efforts.

![]() Choose the right platform for your crowdfunding campaign. When picking a crowdfunding platform, be sure your host offers fully customizable giving pages to your team.

Choose the right platform for your crowdfunding campaign. When picking a crowdfunding platform, be sure your host offers fully customizable giving pages to your team.

![]() Use social media. Crowdfunding relies heavily on social networking, so it only makes sense that it works best when done on social media platforms.

Use social media. Crowdfunding relies heavily on social networking, so it only makes sense that it works best when done on social media platforms.

![]() Have an excellent crowdfunding page. As your campaign progresses, your campaign page should change. Update the information regularly.

Have an excellent crowdfunding page. As your campaign progresses, your campaign page should change. Update the information regularly.

![]() Build your tribe of supporters! Engage with your backers and allow them to co-create value with you.

Build your tribe of supporters! Engage with your backers and allow them to co-create value with you.

We examined many issues, as well as some important ways in which this exciting industry is changing the game for entrepreneurs and startups in line with the advent of new economic and social needs.

We looked at the early roots of crowdfunding, how it is transforming into the modern industry that we know today, and how you can plan and launch your own successful campaign.

We would like to know your opinion on the most suitable source of funding for your startup?

Let us know in the comments below.